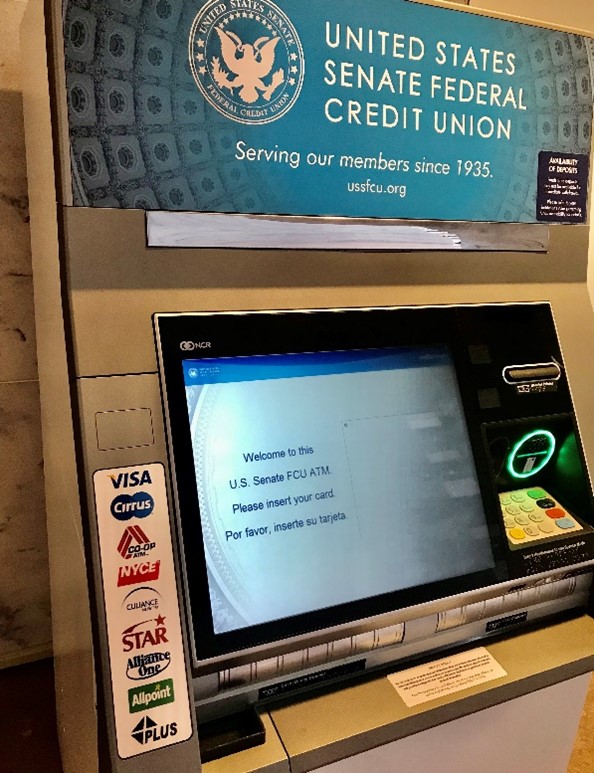

<p>By <span style="background-color:transparent;color:inherit;font-family:inherit;font-size:inherit;text-align:inherit;text-transform:inherit;word-spacing:normal;caret-color:auto;white-space:inherit;">Christine Pollack, Vice President, Government Relations, FMI</span></p><p>This week, I took the photo below of the ATM on the first floor of the Hart Senate Office Building, outside of the United States Senate Federal Credit Union branch. As you can see, there are logos on the left-hand side of the machine of debit routing networks, such as NYCE, Star, and Plus. There is misinformation being spread that when the <a href="https://merchantspaymentscoalition.com/credit-card-competition-act-myths-facts/" target="_blank">bipartisan Credit Card Competition Act</a> is enacted, these networks could be unsecure and harm customer’s financial data. It’s important that this misinformation is cleared up. </p><p>The logos below are of federally regulated, secure networks that route hundreds of thousands of debit transactions every day, including the financial data of Senators and congressional staff who bank at the <a href="https://www.ussfcu.org/" target="_blank">U.S. Senate Federal Credit Union</a> – and likewise at the <a href="https://www.congressionalfcu.org/" target="_blank">Congressional Federal Credit Union</a> on the House side of the U.S. Capitol. These networks are held to extremely high standards under federal law and are chosen by financial institutions – banks and credit unions like the Senate and Congressional Credit Unions – to be enabled on a debit card issued to bank customers, like many Members of Congress, their families, and staff.</p><img sf-custom-thumbnail="true" src="https://www.fmi.org/images/default-source/blog-images/senate-atm.jpg?sfvrsn=1ac12928_1" style="margin-bottom:10px;float:left;" sf-constrain-proportions="true" class="-align-left" width="400" alt="Senate ATM" sf-size="100" /><p>Banks and credit unions that issue debit cards are required, under the Dodd-Frank Act, to enable a second network, unaffiliated with Visa and Mastercard, on which to route debit transactions. The bank or credit union chooses the second network. Now, I’m no banker but I would imagine that these networks would be highly scrutinized by the financial institutions for security and fraud prevention measures before being enabled on a debit card branded by the issuing bank or credit union.<span style="background-color:transparent;color:inherit;font-family:inherit;font-size:inherit;text-align:inherit;text-transform:inherit;word-spacing:normal;caret-color:auto;white-space:inherit;"> </span></p><p>Do you think the U.S. Senate Federal Credit Union, which has been proudly serving their members since 1935, would willingly put the security of Senators’ financial data in the hands of so-called fly-by-night routing networks? Yeah, me neither. </p><p>When the bipartisan <a href="https://merchantspaymentscoalition.com/credit-card-competition-act-myths-facts/" target="_blank">Credit Card Competition Act</a> is enacted and financial institutions issuing consumer credit cards like Chase, Capital One, and Bank of America, are required to select a second, unaffiliated network to be enabled on their branded credit cards, don’t you think bankers would scrutinize the selection of networks (just like they select for their branded debit cards today)?<strong> </strong>I mean, they won’t want the reputational risk of putting your financial data in harm’s way (which would also violate federal law) or losing celebrity endorsers like America’s sweetheart Jennifer Garner.<span style="background-color:transparent;color:inherit;font-family:inherit;font-size:inherit;text-align:inherit;text-transform:inherit;word-spacing:normal;caret-color:auto;white-space:inherit;"> </span></p><p>Why are the handful of large banks that issue consumer credit unions pushing back so hard on the bipartisan Credit Card Competition Act? Because Visa and Mastercard mandate them to sign exclusivity contracts stating that financial transactions for their credit cards will only be routed through Visa or Mastercard. That’s it. It has nothing to do with security or fraud (by the way, the <a href="https://www.federalreserve.gov/paymentsystems/files/debitfees_costs_2021.pdf" target="_blank">Federal Reserve</a> says these unaffiliated debit networks have a better fraud prevention rate than Visa and Mastercard).<span style="background-color:transparent;color:inherit;font-family:inherit;font-size:inherit;text-align:inherit;text-transform:inherit;word-spacing:normal;caret-color:auto;white-space:inherit;"> </span></p><p>The <a href="https://merchantspaymentscoalition.com/mpc-durbin-marshall-and-welch-call-for-passage-of-credit-card-competition-act/" target="_blank">bipartisan Credit Card Competition Act</a> is very simple. It will require the two dozen or so very large banks (and one credit union) that issue 90% of all consumer credit cards to add a second network (which they already enable on their debit cards) on which to route transactions. A credit card won’t have to be reissued to add a logo – this is all done through back-of-the-house software. When we boil it down to that basic level, it seems pretty fishy as to why Visa, Mastercard, and these financial institutions are spending nearly $1 million or more a month to advertise against the Credit Card Competition Act (even sponsoring a donut truck to hand out goodies to congressional staff). </p><p>Congress needs to <a href="https://merchantspaymentscoalition.com/nearly-2000-companies-and-270-trade-associations-call-for-passage-of-credit-card-competition-act/" target="_blank">enact</a> the bipartisan Credit Card Competition Act now. Our economy thrives on competition, and none exists in the credit card market today. Grocery customers and food retailers need relief from hidden swipe fees that the large financial institutions, Visa, and Mastercard levy on everyday purchases like food and consumer goods. And by the way, your airline miles and credit card <a href="https://merchantspaymentscoalition.com/new-study-says-swipe-fee-bill-would-not-lead-to-loss-of-credit-card-rewards/" target="_blank">rewards</a> points <a href="https://merchantspaymentscoalition.com/credit-card-competition-act-myths-facts/" target="_blank">will not go away</a> when the Credit Card Competition Act is enacted.</p>

[#item_full_content]